February 2021 San Francisco Real Estate Market Update

Note: Due to a massive overhaul of our MLS system I was unfortunately unable to pull the statistics for January. The good news is that with our new system, I can now access this data for a large portion of Northern California. If there is an area for which you’re interested in seeing data, please reach out. Also a reminder: statistics are always a month behind in order to get the most recent sold data.

Demand for single family homes continues to soar as low interest rates and a need for more space drives strong buyer demand. Meanwhile the condo market, which took a hit last year is slowly regaining strength. But low interest rates and still-high inventory still make this an excellent time to buy, whether you’re looking to enter the market or considering an investment property. It continues to be a binary market with single family homes getting snapped up quickly and condos just inching along. Below are the stats for February.

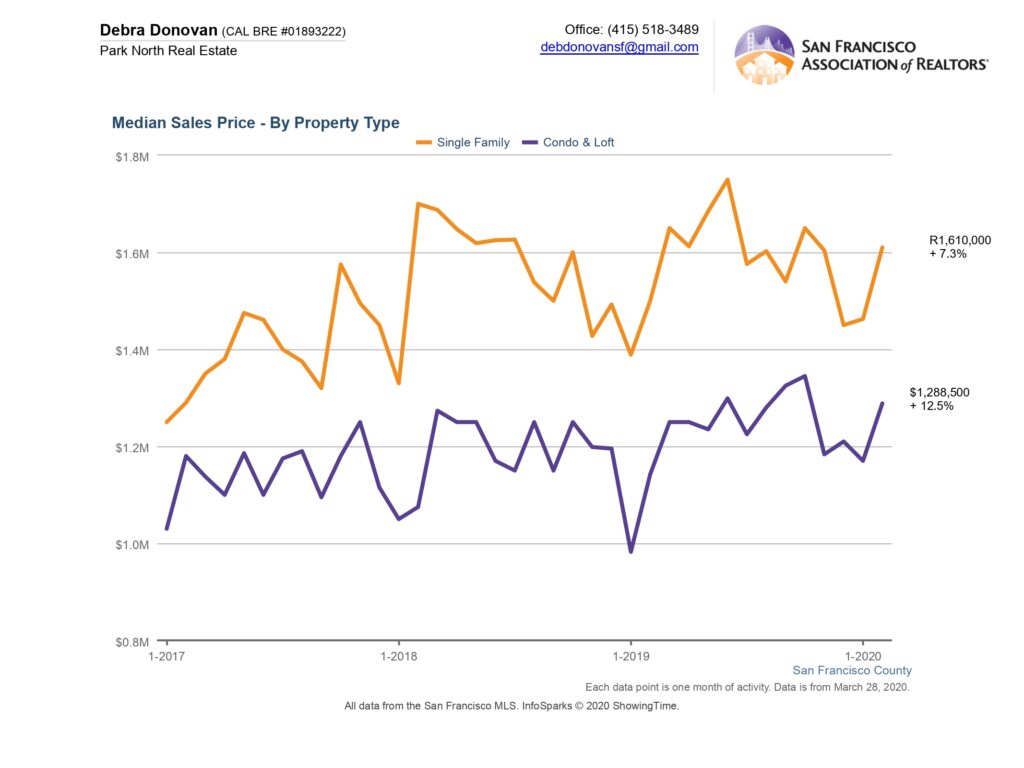

Median Sales Price:

The median price for a single family home continued to rise in February with a 5.1% year-over-year increase to $1,705,000. While the condo market continues to bounce back, pricing still remains slightly below 2020. In February the median price was $1,235,000, down 3.2% compared to last February.

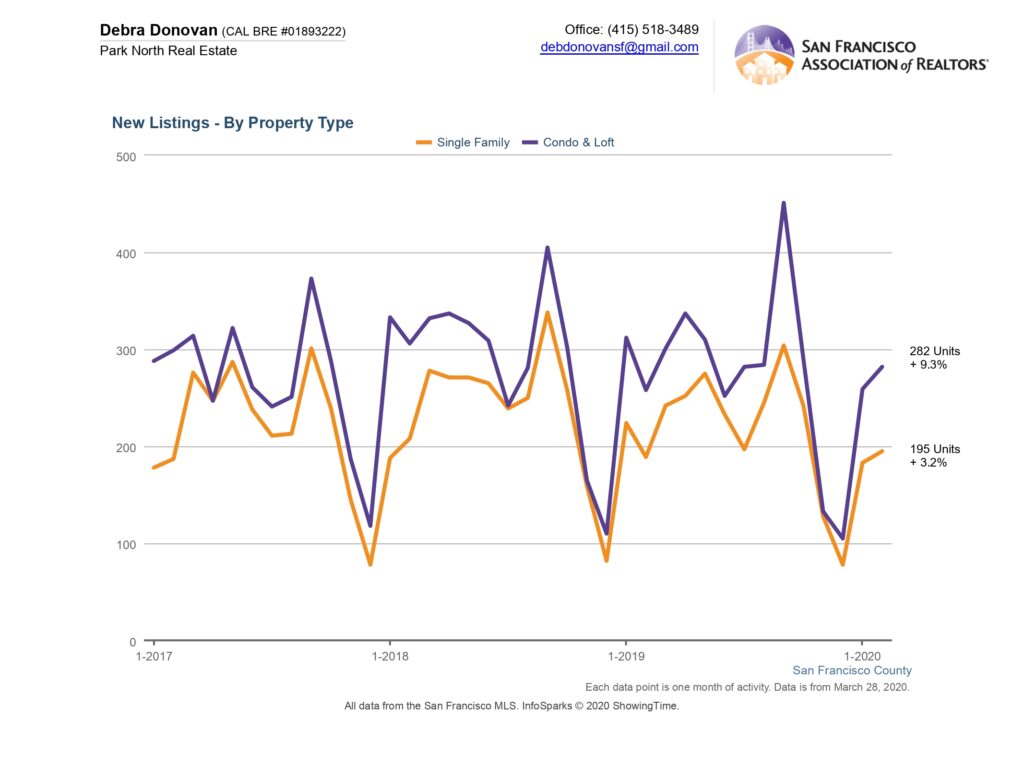

New Listings:

New Listings:

New listings for single family homes were down 22% in February with just 163 new listings coming on the market. Condos and lofts also saw a decrease in new listings as that market starts to level off.

Active Listings:

Active listings are the number of listings available for sale at the end of the month. Active single family homes were down almost 19% in February, not surprising given the enormous buyer interest in that market. Condo and loft active inventory was up 37% year-over-year in February. Still, this is significantly less than what we saw in late Summer and Fall of 2020.

Percentage of Properties Selling Over List Price:

Almost 69% of single family homes sold for over their listing price in February, down 5% compared to the same month last year. The single family home market has been fiercely competitive, even more so since the pandemic set in. Condos and lofts, on the other hand, saw almost 37% of properties sell for over their list price, a decrease of 42.5% year-over-year but up compared to the end of 2020.

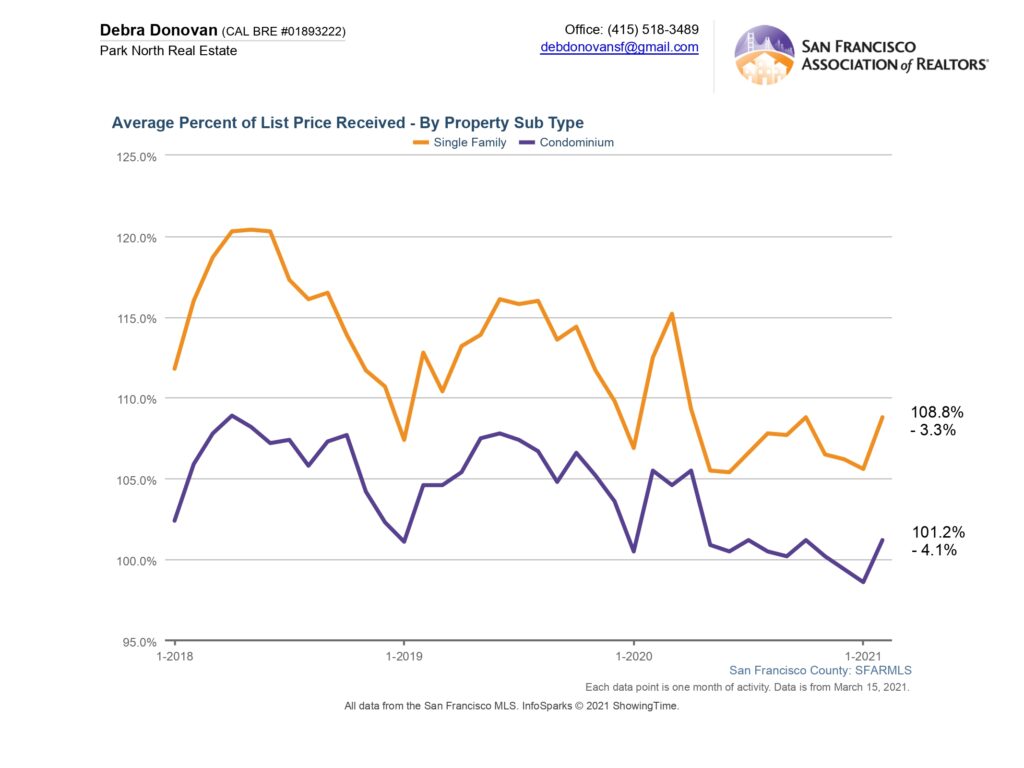

Average Percentage of List Price Received:

Single family homes sold for an average of almost 9% over their list price, down 3.3% compared to last year. Condos and lofts on average sold for just over 1% of their list price, also down compared to last February but up compared to the last couple of months where the average was less than 100%.

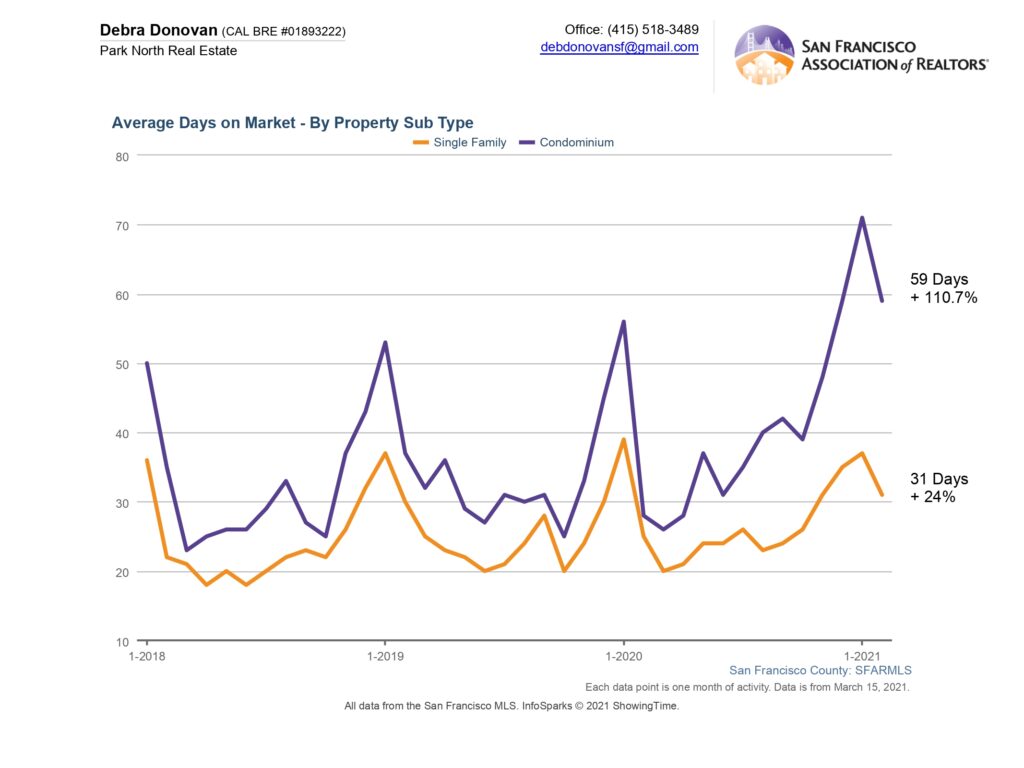

Average Days on Market:

Single family homes spent an average of 31 days on market before accepting an offer, up from last February’s 25 days. Condos and lofts spent an average of 59 days on the market, not surprisingly up over 100% compared to the same month last year.

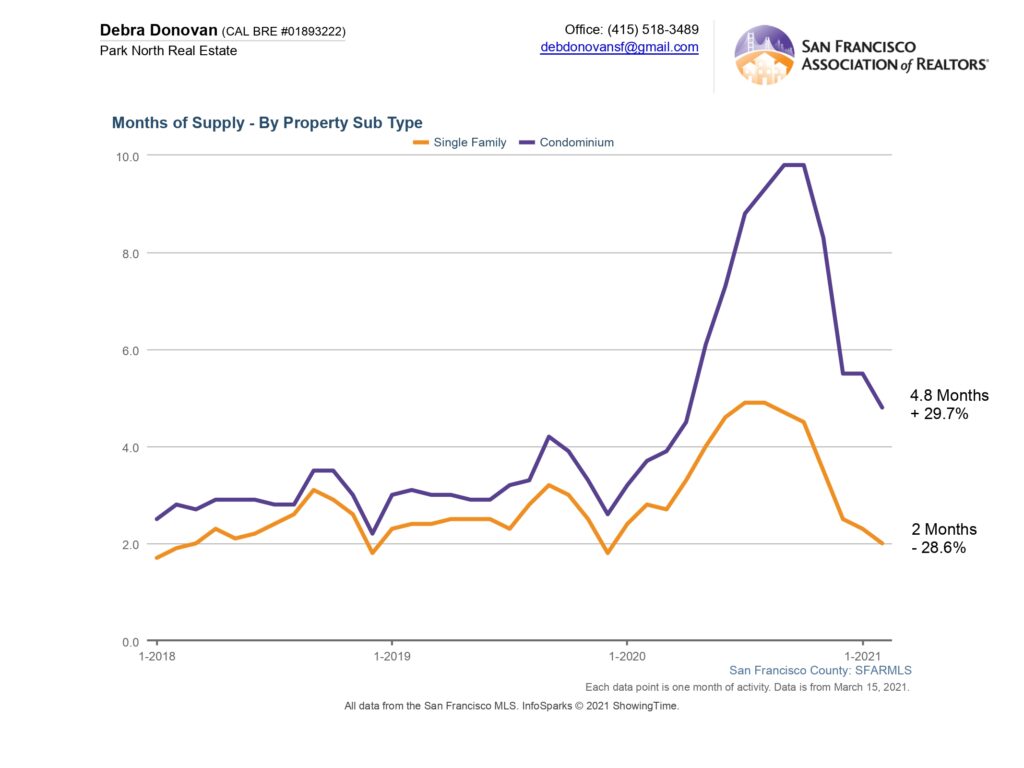

Months Supply of Inventory:

Inventory continues to be low for single family homes with only 2 months of inventory, down 28% year-over-year. February is typically lower in inventory compared to the coming Spring months and there’s still just not enough to satisfy the intense demand. Condos and lofts had almost 5 months of inventory, up almost 30% but significantly lower than the high in Fall 2020.