In spite of being in the “slower” summer months, the San Francisco real estate market continued to tick on at a fairly steady pace in July. Median prices rose slightly compared to June. There was less inventory than in any previous July in the past decade, so unsurprisingly the majority of single family homes and well over half of condos and lofts sold for over their list price. Homes are selling quickly, in under a month, and the supply of inventory is low.

Check out all of the details in the charts below.

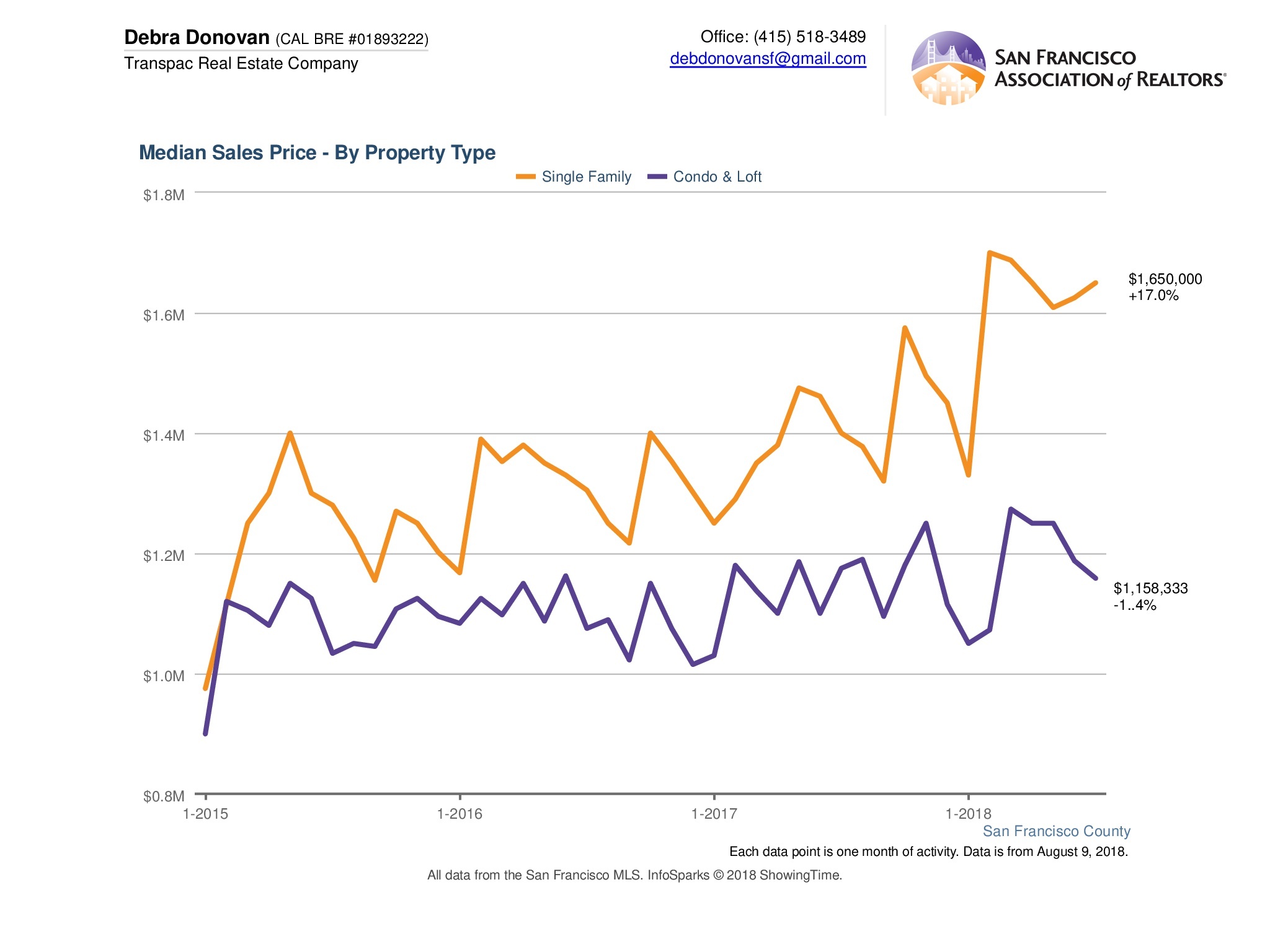

Median Sales Price:

Single family homes jumped again in July to $1,650,000, compared to June’s median price of around $1,620,000, and prices were also up almost 18% from the same month a year ago. Condos and lofts, on the other hand, scooched down a bit compared to last month and July of last year. Demand for single family homes has skyrocketed over the years since there are not many new ones being built. Condos on the other hand have seen an influx of new construction projects, which has kept condo prices overall in check.

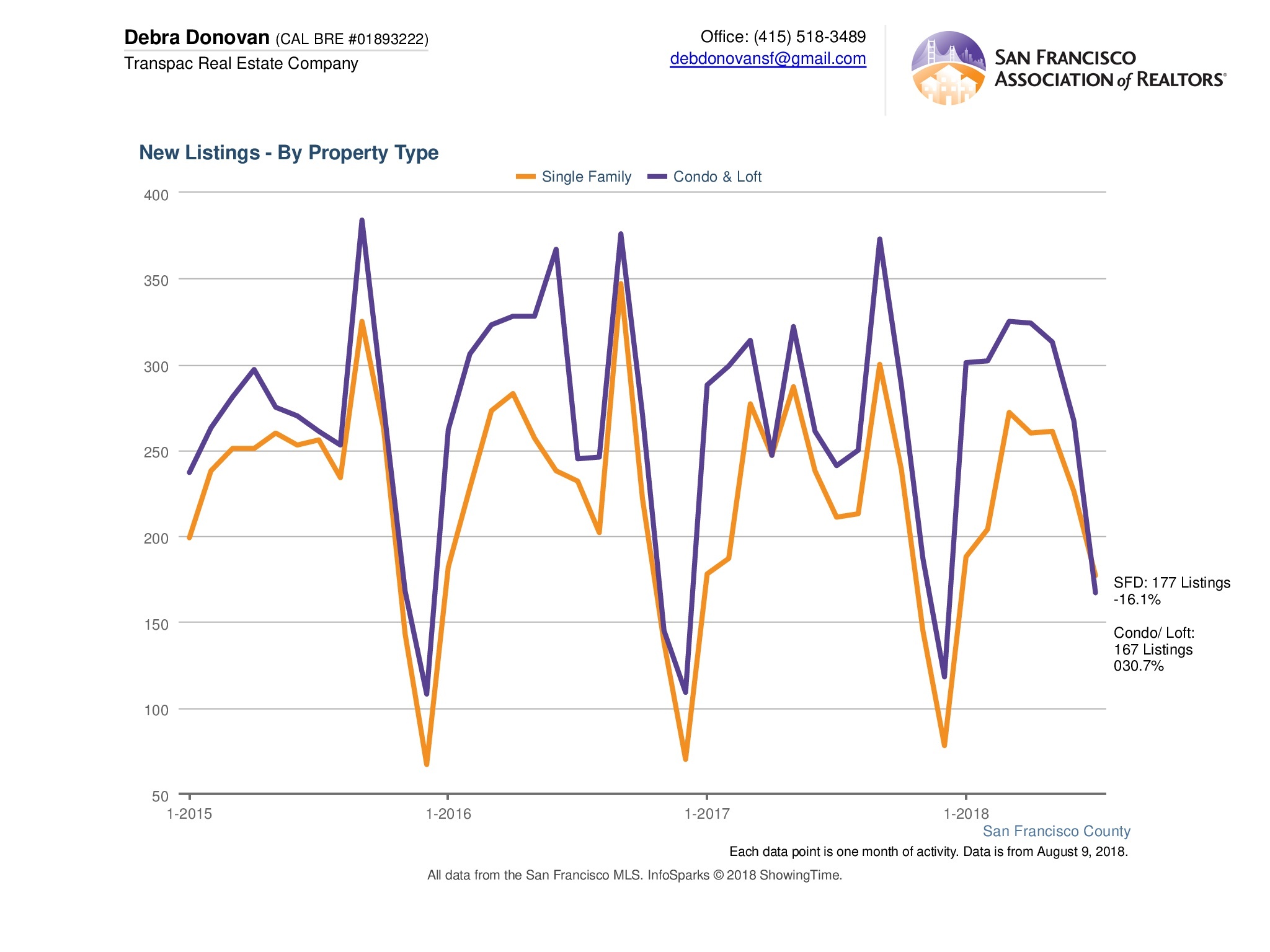

New Listings:

While the summer months are typically lighter on inventory, this July had the lowest level of new listings for the month of July in at least 10 years. Only 177 single family homes and 167 condos and lofts came on-market, a decrease of 16% and over 30% respectively compared to July of last year.

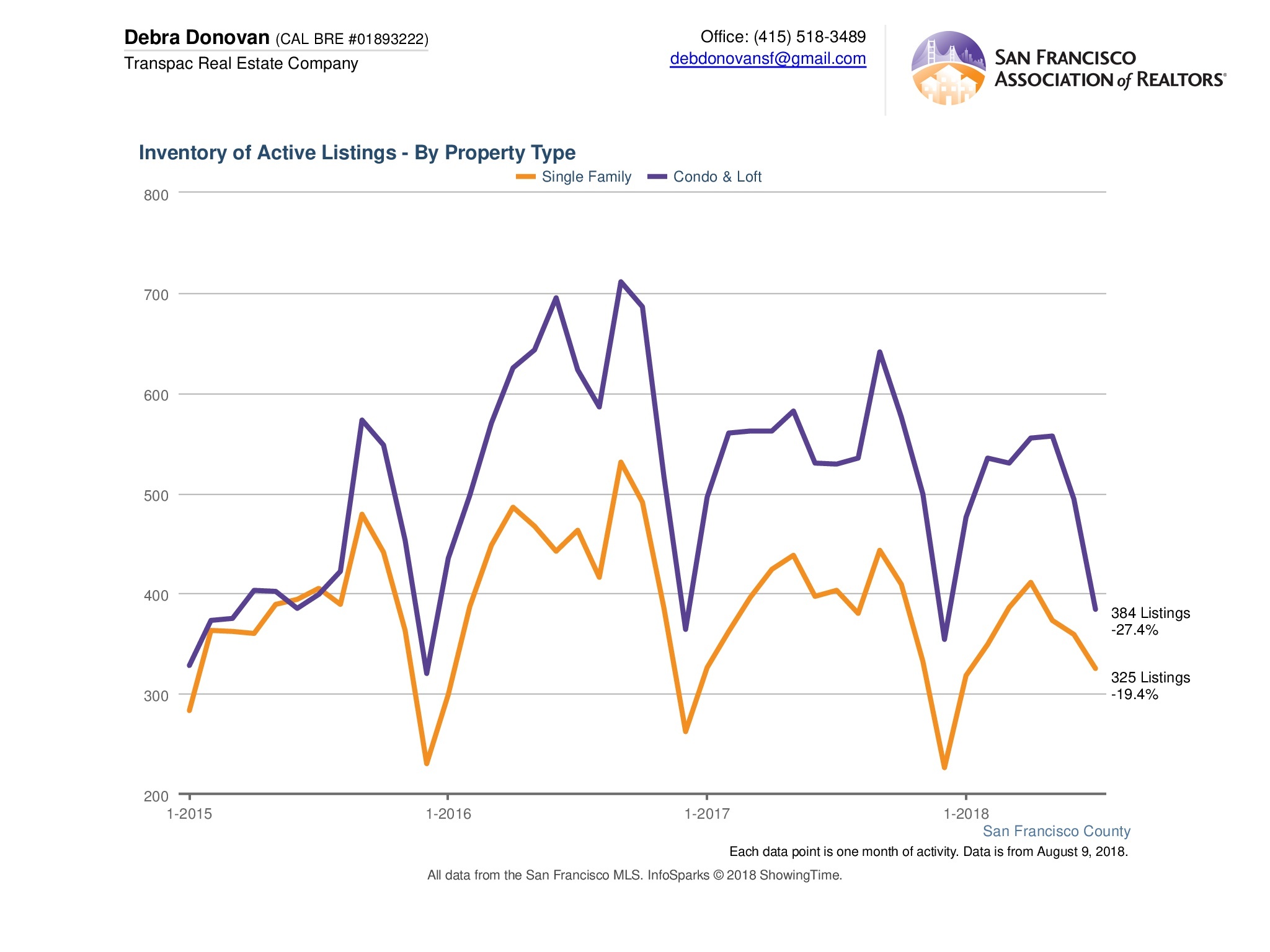

Active Listings:

Active listings, the number of listings available for sale at the end of the month, were also down for single family homes by almost 20% compared to last year. Condos and loft listings were down 27% compared to the same month last year.

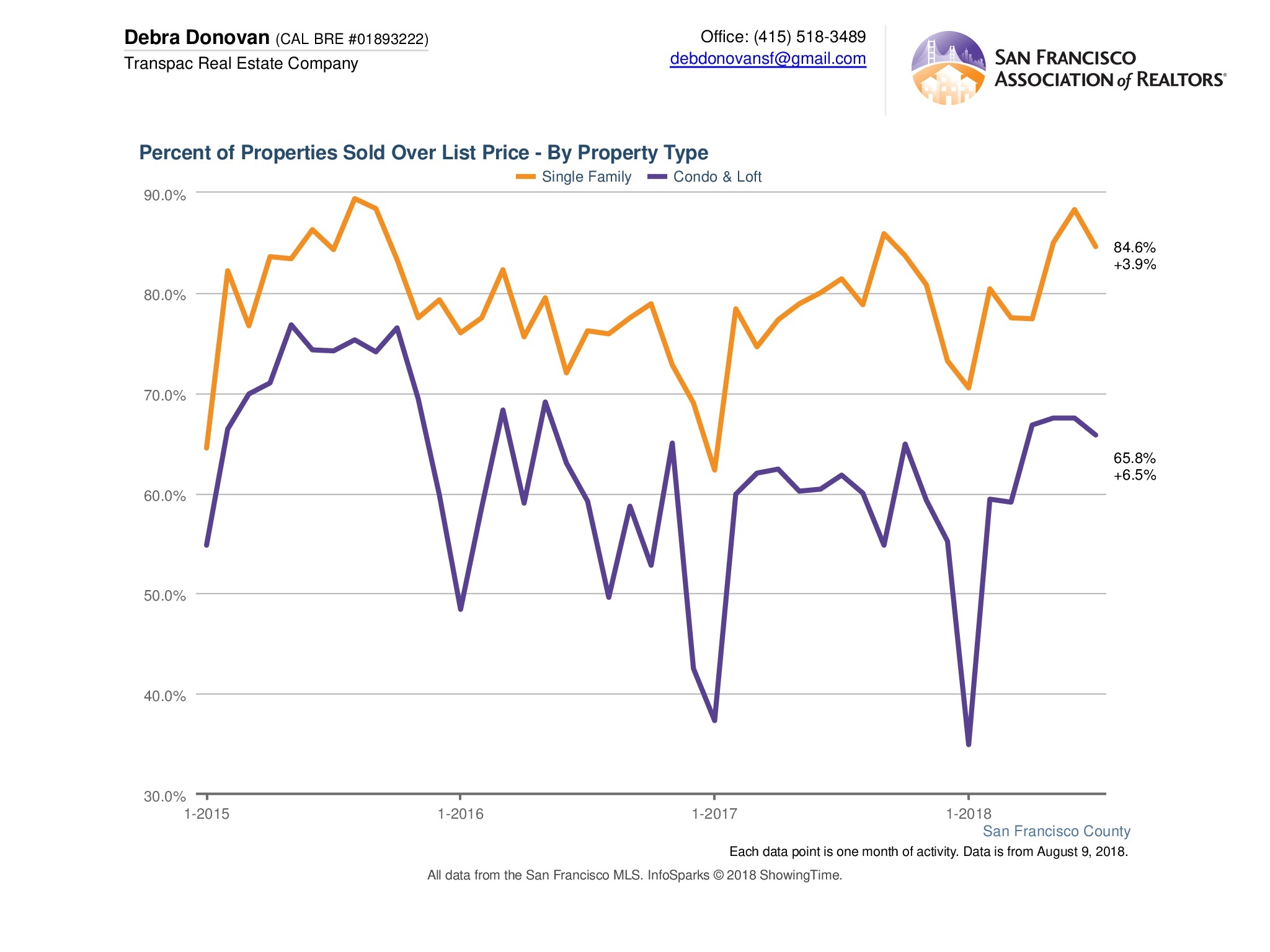

Percentage of Properties Selling Over List Price:

Given the anemic inventory levels it’s not surprising that the majority of homes sold for over their list price. In July more than 84% of single family homes sold for over list price, an increase of almost 4% compared to the same month last year. 66% of condos and lofts sold for over their list price, up 6.5% compared to July of last year.

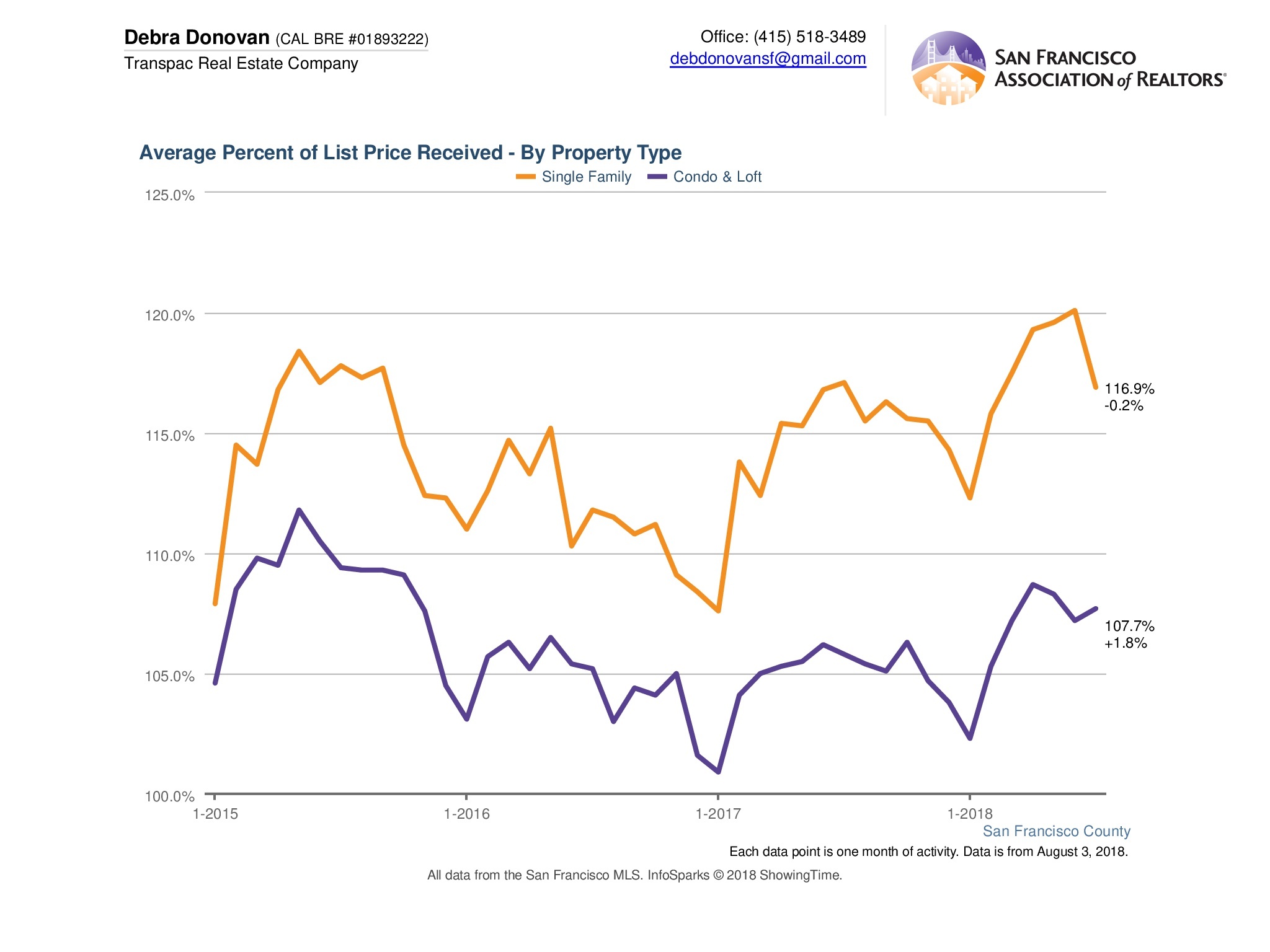

Average Percentage of List Price Received:

Single family homes sold for an average of about 17% over their list price in July, which was relatively flat compared to the same month last year. Condos and lofts sold on average about 8% over their list price, an almost 2% increase compared to last year.

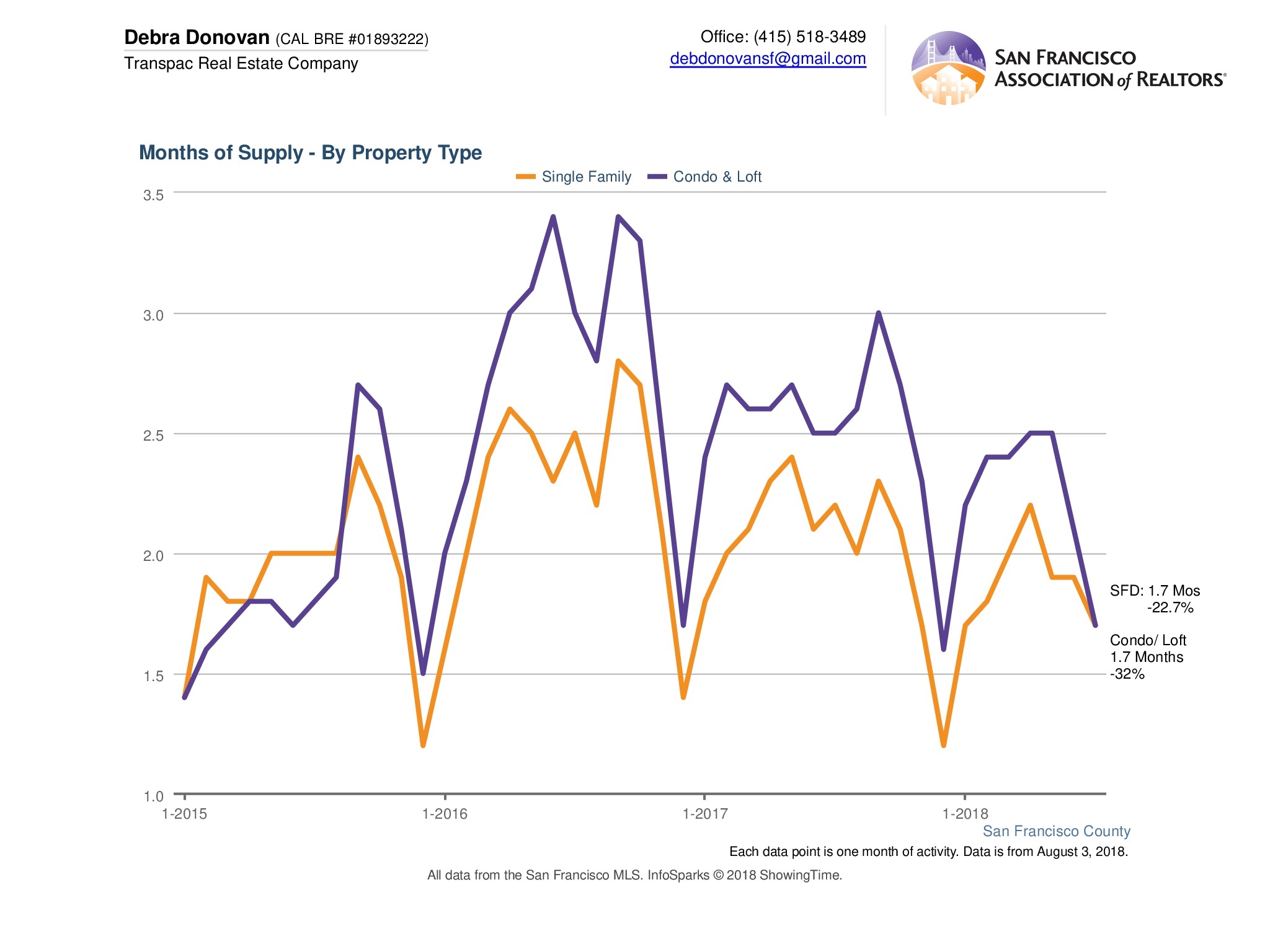

Months Supply of Inventory:

MSI dipped below 2 months for both single family homes and condo/ lofts. Single family homes had only 1.7 months of inventory, 23% lower than July 2017 and the lowest since January. Condos and lofts also had only 1.7 months, a decrease of 32% and the lowest since December 2017. A balanced market would have 5-6 months of inventory, so it’s still very much a seller’s market.

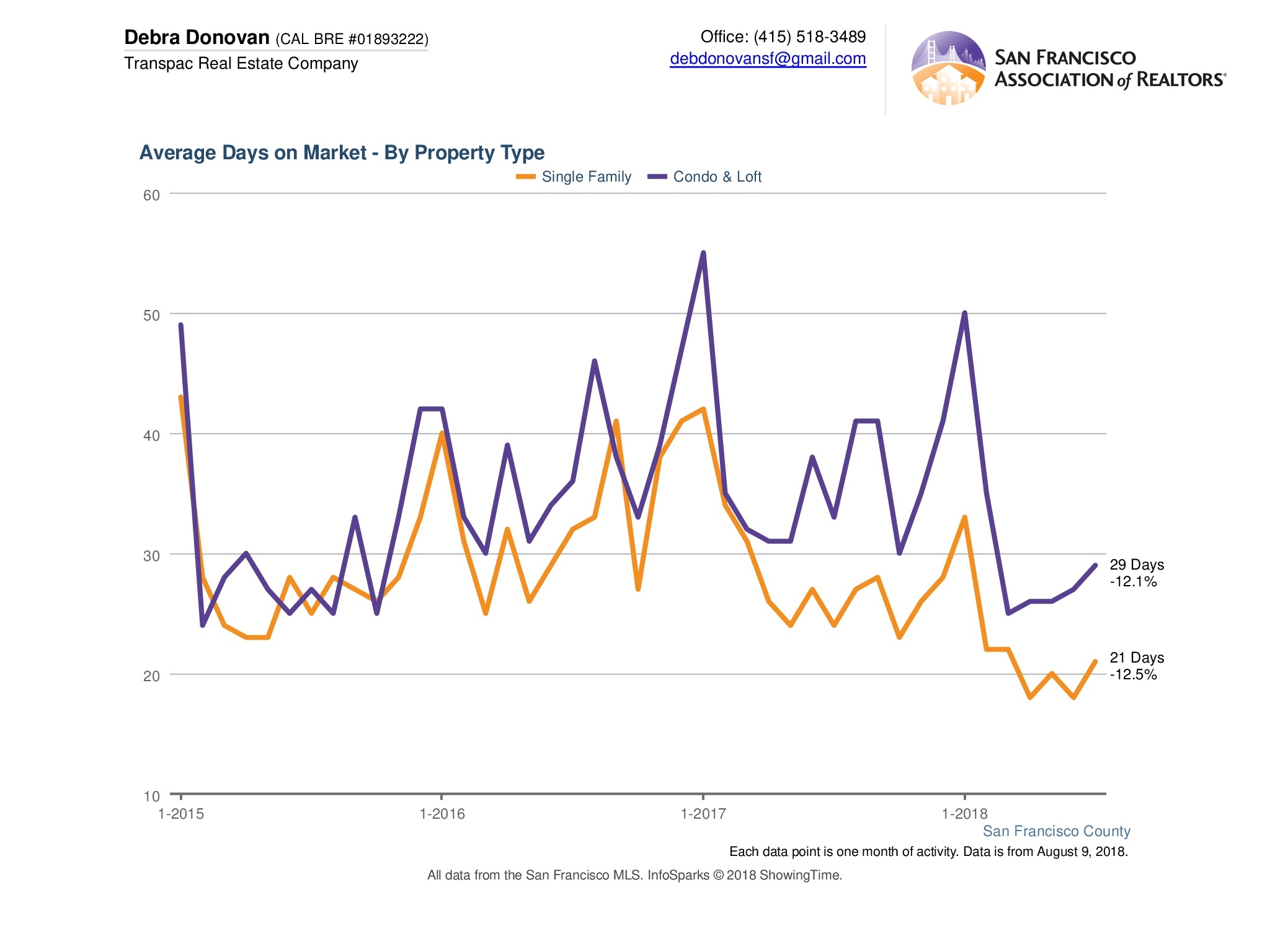

Average Days on Market:

The average single family home spent 21 days on the market before accepting an offer, a 12.5% decline from the same month last year. Condos and lofts spent an average of 29 days on the market, a decrease of 12.1% compared to July 2017. For the most part, homes continue to sell quickly.

The fine print: All information deemed reliable but not guaranteed or warranted. Data comes from MLS so does not include off-market and most new construction condo sales. The San Francisco real estate market is dynamic so statistics can change on a daily basis. These statistics are meant to be a snapshot of the day and time they were pulled.